Borrower Role

If users are seeking more leverage or are at risk of liquidation on Aave, they can migrate to Twyne to enhance their borrowing power. This can be achieved by either boosting the borrowing power of their existing Lending Market-eligible collateral or by depositing alternative collateral accepted by Twyne. Behind the scenes, lenders secure these loans, ensuring stability.

Main Features:

- Increase borrowing power of your Lending Market collateral

- Use a wider range of assets as collateral

Whether users aim to increase leverage for looping strategies or want to strengthen their positions to avoid liquidation, Twyne offers flexible options.

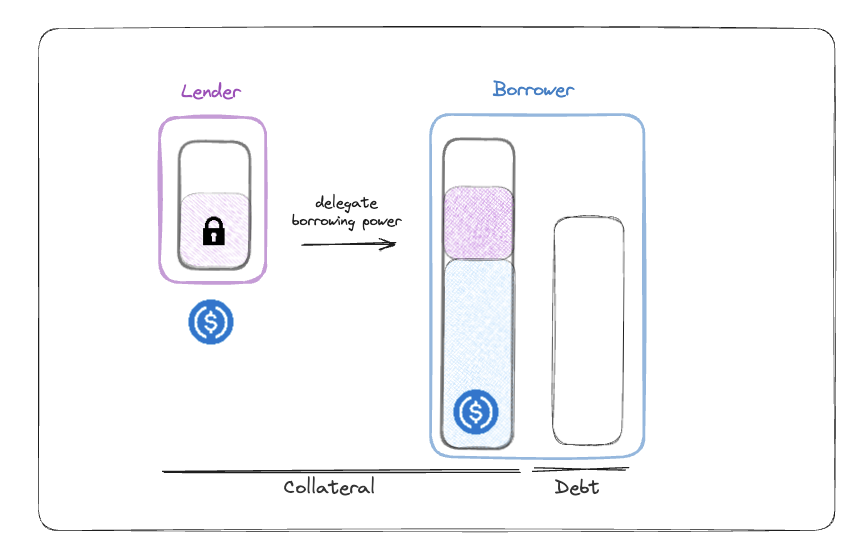

1. Boosted Borrowing

The Credit Liquidity Provider (CLP) delegates credit to the Borrower.

- USDC borrowing power 80%

-

CLP restakes 12.5 USDC Borrowing power: 10 USDC -

Borrower deposits 100 USDC Borrowing power: 80 USDC - By combining these positions, the Borrower can tap into 90 USDC worth of borrowing power, i.e. an effective collateralization factor of 90%.

This is how Twyne offers 90% collateral factor on USDC. It is backed with real collateral provided by CLPs willing to take the risk. This approach is particularly useful because it requires only a small capital input to significantly boost assets. In exchange, the Borrower pays interest on the CLP funds being utilized.

Boosted borrowing can even be accessed on demand as a last ditch effort to avoid liquidations. Instead of risking a 5-10% instant liquidation penalty, it is reasonable to expect a Borrower to be willing to pay the same percentage as an annualized lending rate. Applied to the above example, the Borrower would pay 5 USDC annualized (5% APR on 100 USDC) to utilize the boosted borrowing power provided by the CLPs 12.5 USDC. This works our to a 40% APR for the CLP.

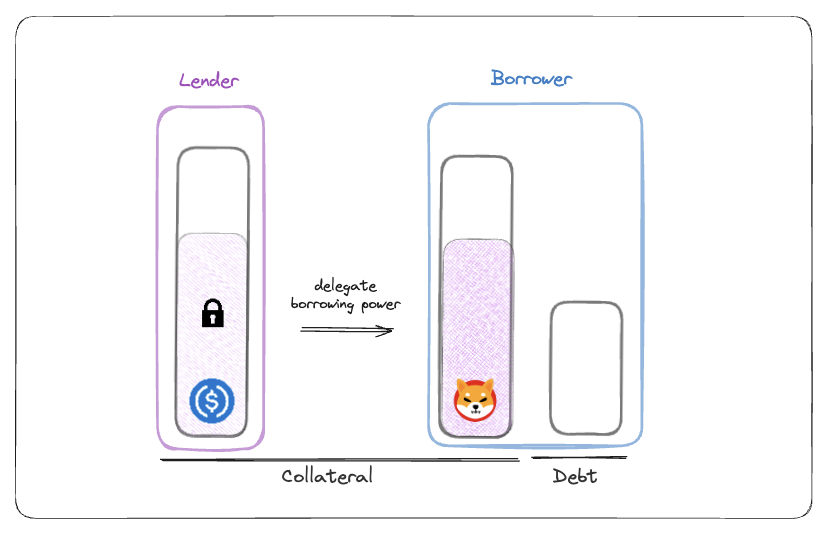

2. Long-Tail Asset Collateral

In this scenario the Borrower’s collateral has no borrowing power on the Lending Market. The CLP delegates credit to the borrower through a collateral asset that is recognized by the Lending Market.

- SHIBA borrowing power 0%

- USDC restakes 80%

-

CLP restakes 100 USDC Borrowing power: 80 USDC -

Borrower deposits $100-worth of SHIBA Borrowing power: 0 USDC - SHIBA uses the underlying USDC to borrow from Aave liquidity

While a Lending Market faces fragmented liquidity and risk challenges to integrate new tokens, Twyne integrates seamlessly with existing liquidity pools by allowing CLPs to shoulder risks on behalf of other users. By connecting with existing liquidity across established Lending Markets, Twyne aggregates borrowing without increasing risk for users unwilling to be exposed to it.