Credit Liquidity Provider Role

Credit Liquidity Providers (CLPs) on Twyne can restake their Lending Market collateral to lend their unused borrowing capacity to others, thus transforming their idle borrowing power into a productive asset.

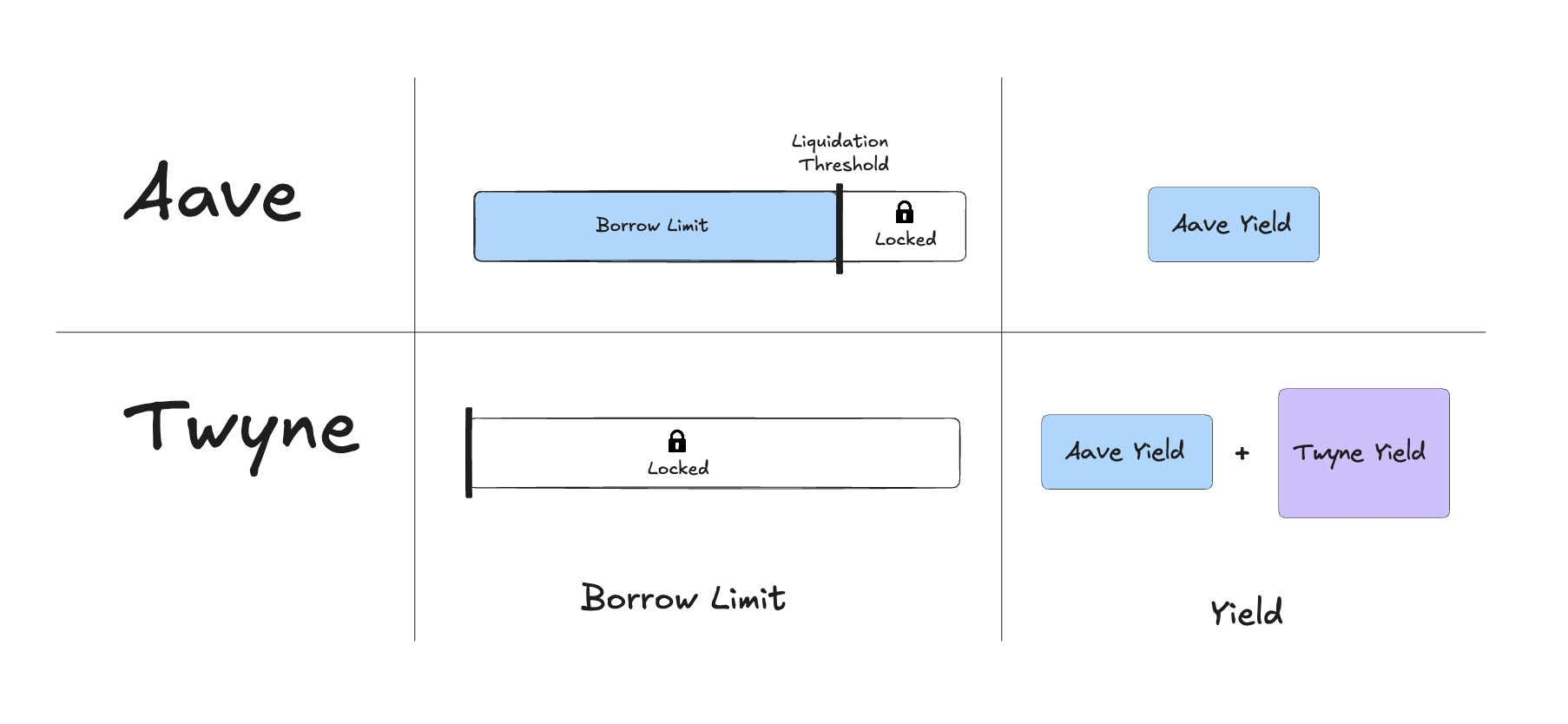

By restaking their Lending Market receipt tokens, lenders earn dual rewards:

- Lending Market’s supply interest rates

- Twyne credit-delegation rates

Currently, over $2 billion in Aave collateral is not being used to borrow. Twyne aims to unlock the potential of this idle capital across bluechip Lending Markets by putting unused borrowing power to work. CLPs deposit their collateral into Lending Markets and use Twyne to underwrite loans for other users.

By leveraging idle borrowing power, Borrowers can take out bigger loans on Lending Markets as well as leveraging unsupported collateral. This strategy increases overall utilization rates and channels external lending volume through existing Lending Market liquidity pools, boosting utilization for both CLPs and Lending Market lenders not actively operating through Twyne (win-win).